Moving to a new home in Vancouver can be both exciting and nerve-wracking, especially when you’re concerned about protecting your valuable belongings during the transition. Whether you’re relocating within the Lower Mainland or moving from another province, understanding your moving insurance options is crucial for peace of mind. With Vancouver’s bustling streets, unpredictable weather, and the inherent risks of any relocation, having the right moving insurance Vancouver coverage can save you from unexpected financial losses. At Richmond Moving Company, we’ve helped thousands of families and businesses navigate their moves across Vancouver, Burnaby, Delta, New Westminster, Surrey, and Richmond, and we understand firsthand how important proper insurance coverage is for a successful relocation. In this comprehensive guide, we’ll walk you through everything you need to know about choosing the right moving insurance to protect your most precious possessions.

Understanding Moving Insurance: Why It Matters in Vancouver

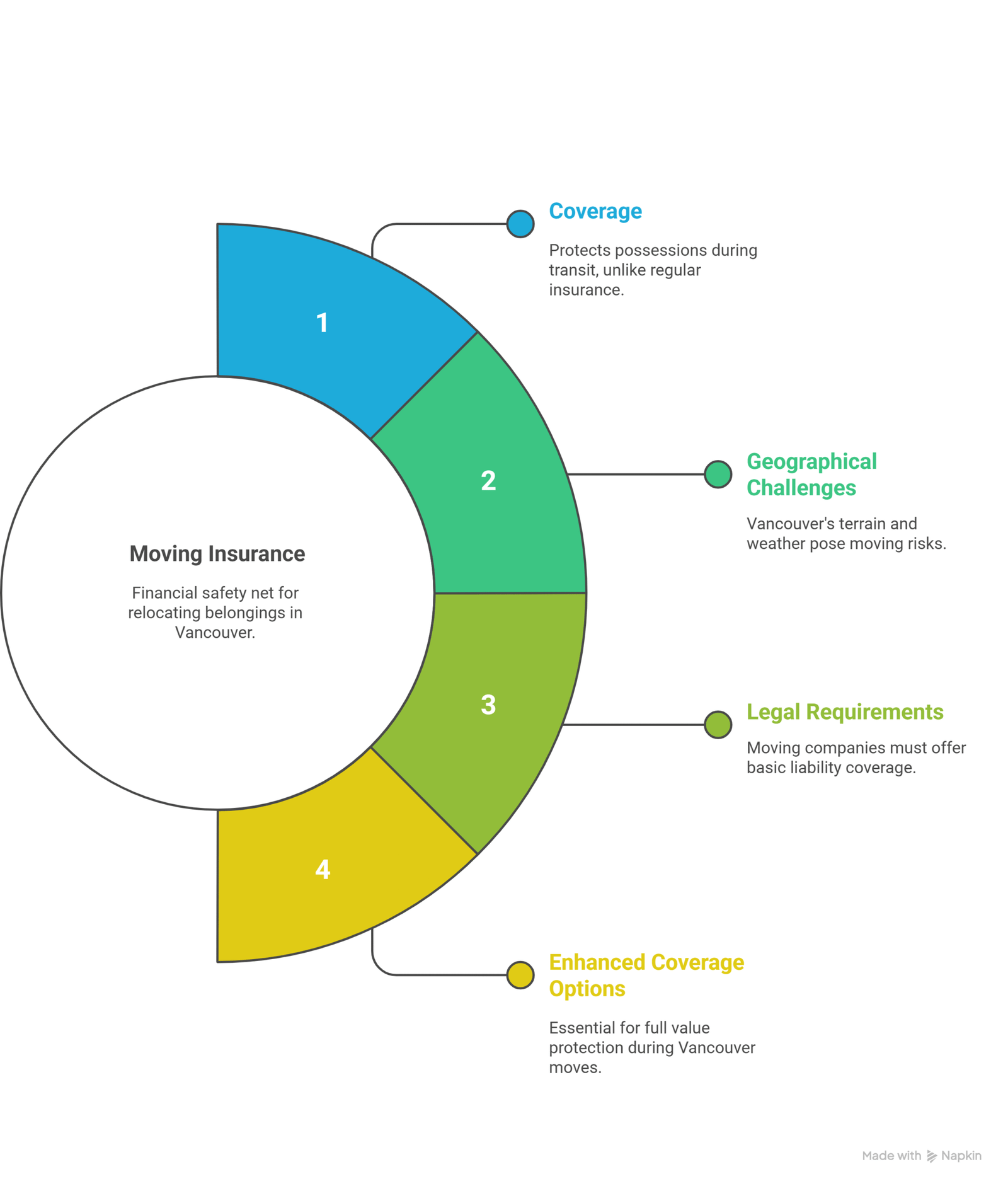

Moving insurance is your financial safety net when relocating your household or office belongings. Unlike regular homeowner’s or renter’s insurance, which typically doesn’t cover items during transit, moving company insurance Vancouver specifically protects your possessions while they’re being transported from your old location to your new one.

Vancouver’s unique geographical challenges make moving insurance even more critical. From navigating steep hills in areas like Queen Elizabeth Park to dealing with narrow streets in historic neighbourhoods like Gastown, there are numerous scenarios where accidents could occur. Additionally, British Columbia’s frequently changing weather conditions—from sudden rainstorms to occasional snow—can create unexpected challenges during your move.

When you work with a professional moving company, they’re required by law to offer basic liability coverage. However, this standard protection often falls short of covering the full value of your belongings. That’s why understanding your options for enhanced coverage is essential for any Vancouver move.

Types of Moving Insurance Coverage Available

Basic Liability Coverage (Released Value Protection)

Every licensed moving company must provide basic liability coverage, also known as released value protection. This is the most economical option, typically included at no extra cost. However, the protection is minimal—usually covering only $0.60 per pound per item.

For example, if your 50-pound flat-screen television gets damaged, you’d only receive $30 in compensation, regardless of the item’s actual value. While this coverage meets legal requirements, it rarely provides adequate protection for valuable possessions.

Full-Value Protection

Full-value protection is the most comprehensive relocation insurance BC option available. Under this coverage, your moving company is liable for the replacement value of lost or damaged goods. If an item is lost, damaged beyond repair, or destroyed, the moving company must either:

- Replace the item with one of like kind and quality

- Repair the item to its pre-move condition

- Provide a cash settlement based on the item’s current market value

This coverage typically costs between 1-2% of your shipment’s declared value. For a move valued at $50,000, you might pay $500-$1,000 for full-value protection, but you’ll have peace of mind knowing your belongings are fully covered.

Third-Party Moving Insurance

Third-party insurance companies offer another layer of protection that can complement or replace your moving company’s coverage. These policies often provide more comprehensive coverage and may include:

- Coverage for items packed by the customer

- Protection against mysterious disappearance

- Coverage for specific high-value items like artwork or antiques

- Additional living expenses if your move is delayed

Third-party policies can be particularly valuable when you have expensive collections, family heirlooms, or specialized equipment that requires extra protection.

Moving Insurance Cost Breakdown in Vancouver

| Coverage Type | Cost Range | Protection Level | Best For |

|---|---|---|---|

| Basic Liability | Free (included) | $0.60 per pound | Budget-conscious moves with minimal valuables |

| Full-Value Protection | 1-2% of shipment value | Full replacement value | Most residential and commercial moves |

| Third-Party Insurance | $200-$800+ | Customizable coverage | High-value items, specialty collections |

| Hybrid Coverage | Varies | Combines multiple protections | Complex moves with diverse needs |

How to Evaluate Your Moving Insurance Needs

Inventory Your Belongings

Start by creating a detailed inventory of everything you’re moving. Pay special attention to:

- Electronics and appliances

- Furniture and artwork

- Jewelry and precious items

- Important documents and photographs

- Specialty items like musical instruments or collectibles

For each category, estimate the replacement cost. This exercise will help you determine the total value of your shipment and appropriate coverage levels.

Consider Your Risk Tolerance

Ask yourself these important questions:

- Can you afford to replace damaged items out of pocket?

- Do you have irreplaceable family heirlooms or sentimental items?

- Are you moving during challenging weather conditions?

- How complex is your move (multiple stops, storage, long distance)?

Review Existing Insurance Policies

Check your homeowner’s or renter’s insurance policy to understand what moving-related coverage you might already have. Some policies provide limited coverage for belongings in transit, but this is typically minimal and may have significant restrictions.

What Moving Insurance Covers (and What It Doesn’t)

Typically Covered:

- Damage from accidents during loading, transport, or unloading

- Loss due to fire, collision, or overturning of the moving vehicle

- Theft from the moving truck

- Water damage from vehicle accidents or weather (depending on policy)

Usually Not Covered:

- Items packed by the customer (unless specifically included)

- Normal wear and tear

- Damage from improper packing by non-professionals

- Acts of war, nuclear reaction, or governmental action

- Perishable items, plants, and hazardous materials

- Damage to items already in poor condition

Choosing a Moving Company with Proper Insurance

When selecting a moving company in Vancouver, insurance should be a primary consideration. Here’s what to look for:

Licensing and Certification

Ensure your moving company is properly licensed. In British Columbia, legitimate movers should have appropriate business licenses and comply with provincial regulations. At Richmond Moving Company, we maintain all necessary licenses and certifications to operate throughout Vancouver, Burnaby, Delta, New Westminster, Surrey, and Richmond.

Insurance Documentation

Request to see the moving company’s insurance certificates and understand their coverage limits. A reputable company will readily provide this information and explain your options clearly.

Track Record and Reviews

Research the company’s reputation for handling claims fairly and efficiently. Look for testimonials that specifically mention how the company handled damaged or lost items.

Special Considerations for Vancouver Moves

Weather-Related Risks

Vancouver’s climate presents unique challenges. Heavy rainfall during fall and winter months can create slippery conditions, while summer heat can affect certain items. Discuss weather-related coverage with your moving company and consider timing your move during favourable conditions when possible.

High-Value Areas

If you’re moving to or from high-value Vancouver neighbourhoods like Shaughnessy, West Vancouver, or Yaletown, you likely have valuable possessions that warrant enhanced insurance coverage. Don’t rely on basic liability protection for luxury items.

Condo and Apartment Moves

Vancouver’s numerous high-rise buildings present unique challenges. Ensure your insurance covers potential damage from elevator use, narrow hallways, and the need for specialized equipment. Some policies may have restrictions for moves involving multiple flights of stairs or elevator usage.

Steps to File a Moving Insurance Claim

If damage or loss occurs during your move, follow these steps:

- Document immediately: Take photos of damaged items and packaging before cleanup

- Notify your moving company: Report the issue within the timeframe specified in your contract (usually 9 months)

- Keep records: Save all receipts, repair estimates, and correspondence

- Be persistent: Follow up regularly on claim status

- Understand the process: Claims can take 30-120 days to resolve completely

Tips for Maximizing Your Coverage

- Professional packing: Use professional packing services when possible, as items packed by professionals typically receive better coverage

- Accurate valuation: Don’t undervalue your shipment to save on insurance costs

- Special handling: Identify high-value items that may need special attention or separate coverage

- Read the fine print: Understand deductibles, exclusions, and claim procedures before moving day

- Keep receipts: Maintain purchase receipts and appraisals for valuable items

Making the Smart Choice for Your Vancouver Move

Choosing the right moving insurance doesn’t have to be complicated, but it does require careful consideration of your specific needs and circumstances. Start by honestly assessing the value of your belongings and your financial ability to replace damaged items. For most Vancouver residents, full-value protection offers the best balance of comprehensive coverage and reasonable cost.

Remember that the cheapest option isn’t always the best value. When you consider the emotional and financial impact of losing family heirlooms or expensive electronics, investing in proper coverage makes perfect sense. Additionally, working with an established, insured moving company like Richmond Moving Company provides an extra layer of security and professional expertise.

Frequently Asked Questions

What’s the difference between moving insurance and moving company liability? Moving company liability is the basic coverage (typically $0.60 per pound) that all licensed movers must provide. Moving insurance refers to enhanced coverage options like full-value protection or third-party policies that provide more comprehensive protection.

Do I need moving insurance for a local Vancouver move? Even for local moves within Vancouver, accidents can happen. While the risk may be lower than long-distance moves, valuable items can still be damaged during loading, transport, or unloading. The decision depends on your belongings’ value and your risk tolerance.

How much does full-value protection cost for a typical Vancouver move? Full-value protection typically costs 1-2% of your shipment’s declared value. For a $30,000 household move, expect to pay $300-$600 for this enhanced coverage. The exact cost varies by moving company and specific terms.

Can I buy moving insurance after my move has started? No, moving insurance must be purchased before your move begins. Most companies require insurance decisions to be made when you book your move or at least several days before moving day.

What should I do if my current moving company doesn’t offer adequate insurance options? If your moving company’s insurance options don’t meet your needs, consider purchasing third-party coverage or switching to a company that offers better protection. Don’t compromise on insurance to save a few dollars—the potential losses far outweigh the premium costs.

Protect Your Move with Professional Expertise

Making the right choice about moving insurance Vancouver coverage is just one part of planning a successful relocation. At Richmond Moving Company, we understand that every move is unique, and we’re committed to helping you protect your belongings every step of the way. Our experienced team serves Vancouver, Burnaby, Delta, New Westminster, Surrey, and Richmond with comprehensive moving services designed to meet your specific needs.

Whether you’re planning a local move in Vancouver, need professional packing services, or require specialized piano moving services, we’re here to ensure your relocation is smooth, safe, and properly insured.

Don’t leave your valuable belongings to chance. Contact Richmond Moving Company today at (604) 330-5130 to discuss your moving insurance options and get a personalized quote for your upcoming Vancouver move. Our friendly, professional team is ready to answer your questions and help you choose the right coverage for complete peace of mind. Visit our contact page to schedule your free consultation and take the first step toward a worry-free relocation experience.